Tag: war

-

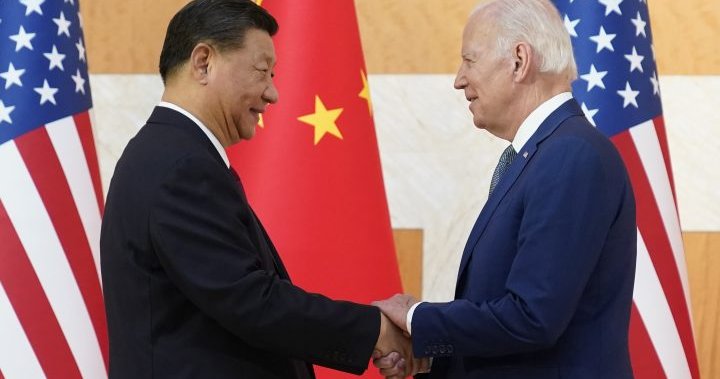

Tech war brewing as China hits back at U.S. limitations on state-of-the-art computer chips – Nationwide

Furious at U.S. attempts that reduce off access to technological innovation to make sophisticated computer chips, China’s leaders appear to be battling to figure out how to retaliate devoid of hurting their possess ambitions in telecoms, synthetic intelligence and other industries. Read a lot more: China suggests most current U.S. export controls on chips will…

-

Well-known npm offer deletes data files to protest Ukraine war

This month, the developer at the rear of the popular npm package ‘node-ipc’ released sabotaged variations of the library in protest of the ongoing Russo-Ukrainian War. Newer versions of the ‘node-ipc’ package began deleting all info and overwriting all documents on developer’s devices, in addition to creating new text files with “peace” messages. With over a million weekly downloads, ‘node-ipc’ is a…